What Does Tax Exempt Mean In Canada . If you earn foreign income, some of it may be exempt due to a tax treaty between canada and the country where the income. If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. Taxable goods and services refer to those that are taxed at 13% and eligible for itcs (input tax credits). Individuals resident in canada are subject to canadian income tax on worldwide income. Bank fees are exempt items. Relief from double taxation is provided. There are two kinds of things that are not taxed: Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a. Cash payment on honorariums, is not exempt nor. The tip on the restaurant bill is an exempt item.

from www.slideserve.com

Individuals resident in canada are subject to canadian income tax on worldwide income. Relief from double taxation is provided. Taxable goods and services refer to those that are taxed at 13% and eligible for itcs (input tax credits). Cash payment on honorariums, is not exempt nor. There are two kinds of things that are not taxed: Bank fees are exempt items. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a. If you earn foreign income, some of it may be exempt due to a tax treaty between canada and the country where the income. If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. The tip on the restaurant bill is an exempt item.

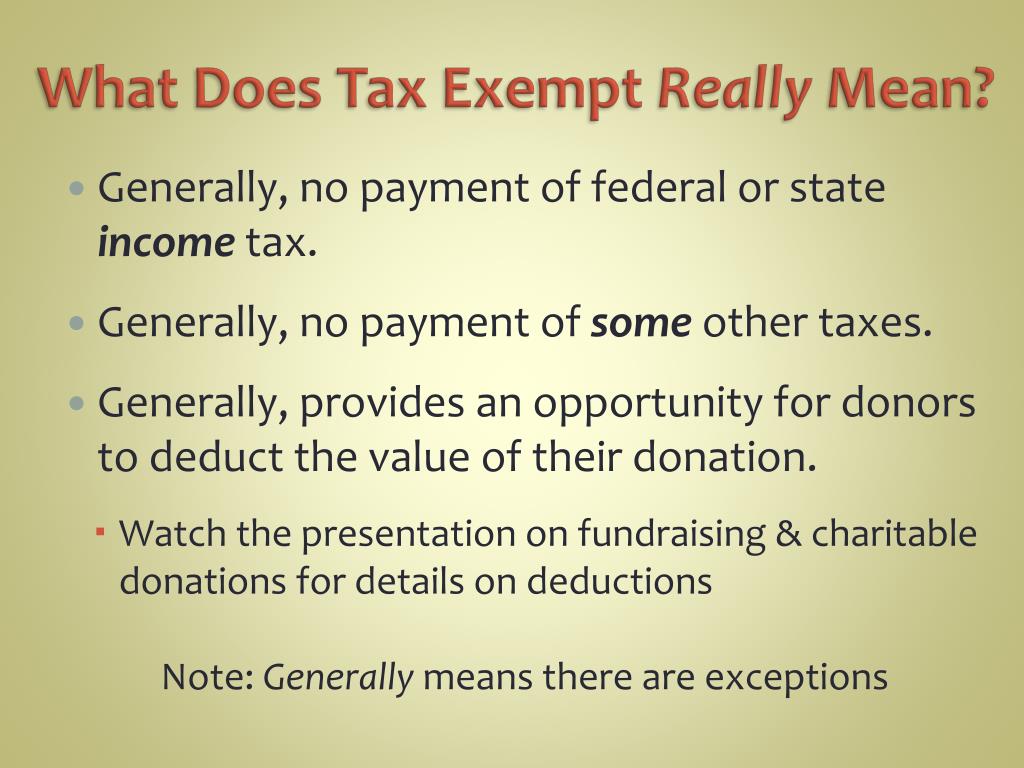

PPT Tax Exempt Status PowerPoint Presentation, free download ID6520067

What Does Tax Exempt Mean In Canada Relief from double taxation is provided. The tip on the restaurant bill is an exempt item. Cash payment on honorariums, is not exempt nor. There are two kinds of things that are not taxed: Individuals resident in canada are subject to canadian income tax on worldwide income. Relief from double taxation is provided. If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. Taxable goods and services refer to those that are taxed at 13% and eligible for itcs (input tax credits). Bank fees are exempt items. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a. If you earn foreign income, some of it may be exempt due to a tax treaty between canada and the country where the income.

From www.dreamstime.com

Conceptual Caption Tax Exempt. Business Overview or Transactions What Does Tax Exempt Mean In Canada The tip on the restaurant bill is an exempt item. Relief from double taxation is provided. Taxable goods and services refer to those that are taxed at 13% and eligible for itcs (input tax credits). Cash payment on honorariums, is not exempt nor. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would. What Does Tax Exempt Mean In Canada.

From economictimes.indiatimes.com

Difference between tax exemption, tax deduction and tax rebate The What Does Tax Exempt Mean In Canada If you earn foreign income, some of it may be exempt due to a tax treaty between canada and the country where the income. Taxable goods and services refer to those that are taxed at 13% and eligible for itcs (input tax credits). Tax exemption is the reduction or removal of a liability to make a compulsory payment that would. What Does Tax Exempt Mean In Canada.

From blog.compliancely.com

What is the Importance Of Tax Exempt Organization Search (TEOS What Does Tax Exempt Mean In Canada If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. There are two kinds of things that are not taxed: The tip on the restaurant bill is an exempt item. Taxable goods and services refer to those that are taxed at 13% and eligible for itcs (input. What Does Tax Exempt Mean In Canada.

From www.youtube.com

What Does Tax Exempt Mean? YouTube What Does Tax Exempt Mean In Canada Cash payment on honorariums, is not exempt nor. There are two kinds of things that are not taxed: Relief from double taxation is provided. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a. The tip on the restaurant bill is an exempt item. Individuals resident in canada. What Does Tax Exempt Mean In Canada.

From www.paynortheast.com

What Does it Mean When an Employee Is Tax Exempt? What Does Tax Exempt Mean In Canada There are two kinds of things that are not taxed: If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a. The tip on the restaurant. What Does Tax Exempt Mean In Canada.

From cbselibrary.com

Tax Exempt Certificate How to Get a Tax Exemption Certificate CBSE What Does Tax Exempt Mean In Canada Relief from double taxation is provided. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a. Taxable goods and services refer to those that are taxed at 13% and eligible for itcs (input tax credits). The tip on the restaurant bill is an exempt item. Individuals resident in. What Does Tax Exempt Mean In Canada.

From www.1investing.in

What Does Tax Exempt Mean? India Dictionary What Does Tax Exempt Mean In Canada If you earn foreign income, some of it may be exempt due to a tax treaty between canada and the country where the income. The tip on the restaurant bill is an exempt item. If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. Individuals resident in. What Does Tax Exempt Mean In Canada.

From www.youtube.com

What does taxexempt mean? YouTube What Does Tax Exempt Mean In Canada Cash payment on honorariums, is not exempt nor. If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. Individuals resident in canada are subject to canadian income tax on worldwide income. The tip on the restaurant bill is an exempt item. Relief from double taxation is provided.. What Does Tax Exempt Mean In Canada.

From www.wintwealth.com

Exempt Exempt from Tax as per Section 10 What Does Tax Exempt Mean In Canada There are two kinds of things that are not taxed: The tip on the restaurant bill is an exempt item. If you earn foreign income, some of it may be exempt due to a tax treaty between canada and the country where the income. Bank fees are exempt items. Taxable goods and services refer to those that are taxed at. What Does Tax Exempt Mean In Canada.

From corporate.grubhub.com

Tax Exempt Management Grubhub Corporate Accounts What Does Tax Exempt Mean In Canada Relief from double taxation is provided. The tip on the restaurant bill is an exempt item. If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. There are two kinds of things that are not taxed: Cash payment on honorariums, is not exempt nor. If you earn. What Does Tax Exempt Mean In Canada.

From www.superfastcpa.com

What Does Tax Exempt Mean? What Does Tax Exempt Mean In Canada There are two kinds of things that are not taxed: Relief from double taxation is provided. If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. If you earn foreign income, some of it may be exempt due to a tax treaty between canada and the country. What Does Tax Exempt Mean In Canada.

From www.investopedia.com

What Does It Mean To Be Tax Exempt or Have TaxExempt What Does Tax Exempt Mean In Canada If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a. Individuals resident in canada are subject to canadian income tax on worldwide income. There are. What Does Tax Exempt Mean In Canada.

From www.huffpost.com

Canadians Now Paying Lower Taxes Than Americans, OECD Data Shows What Does Tax Exempt Mean In Canada If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. There are two kinds of things that are not taxed: Cash payment on honorariums, is not exempt nor. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be. What Does Tax Exempt Mean In Canada.

From www.youtube.com

Can I file exempt on the IRS Form W4? Tax Withholding Exempt What Does Tax Exempt Mean In Canada If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. Individuals resident in canada are subject to canadian income tax on worldwide income. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a. There are. What Does Tax Exempt Mean In Canada.

From www.patriotsoftware.com

What Does Tax Exempt Mean? Employees Claiming to be Exempt What Does Tax Exempt Mean In Canada If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. Bank fees are exempt items. The tip on the restaurant bill is an exempt item. Individuals resident in canada are subject to canadian income tax on worldwide income. Taxable goods and services refer to those that are. What Does Tax Exempt Mean In Canada.

From pafpi.org

Certificate of TAX Exemption PAFPI What Does Tax Exempt Mean In Canada There are two kinds of things that are not taxed: If you are supplying anything that is exempt, then you cannot recover input taxes (i.e., sales tax paid to suppliers of goods and. Taxable goods and services refer to those that are taxed at 13% and eligible for itcs (input tax credits). Individuals resident in canada are subject to canadian. What Does Tax Exempt Mean In Canada.

From lessoncampusbaecker.z13.web.core.windows.net

What Does Exemption Mean On W4 What Does Tax Exempt Mean In Canada Individuals resident in canada are subject to canadian income tax on worldwide income. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a. Cash payment on honorariums, is not exempt nor. Relief from double taxation is provided. There are two kinds of things that are not taxed: The. What Does Tax Exempt Mean In Canada.

From www.templateroller.com

Form T90 Download Fillable PDF or Fill Online Exempt From Tax What Does Tax Exempt Mean In Canada Cash payment on honorariums, is not exempt nor. Individuals resident in canada are subject to canadian income tax on worldwide income. If you earn foreign income, some of it may be exempt due to a tax treaty between canada and the country where the income. The tip on the restaurant bill is an exempt item. Taxable goods and services refer. What Does Tax Exempt Mean In Canada.